Credit Repair Secrets

Roughly 1% of the population has perfect credit, i.e. a FICO score of 850 (on a scale of 300 to 850). Folks with such a high credit score all have the following traits in common:

How Your Credit Score is Calculated

Credit scores take into account various factors in a person’s financial history. Although the exact formulas for calculating credit scores are closely-guarded secrets, FICO has disclosed the following components and the approximate weighted contribution of each.

Understanding Your Credit Score (FICO)

Dis lacinia pellentesque interdum tincidunt cubilia massa egestas primis ullamcorper velit ultrici molestie dui in feugiat lobortis erat vivamus hac condimentum est, libero nostra aliquet consequat fringilla cras lectus vitae ligula sapien. Aptent torquent magnis habitant turpis…

the-10-myths-of-credit-repair

Lorem ipsum dolor sit amet consectetur adipiscing elit ad, tincidunt senectus felis platea natoque mattis. Dis lacinia pellentesque interdum tincidunt cubilia massa egestas primis ullamcorper velit ultrici molestie dui in feugiat lobortis erat vivamus hac condimentum est…

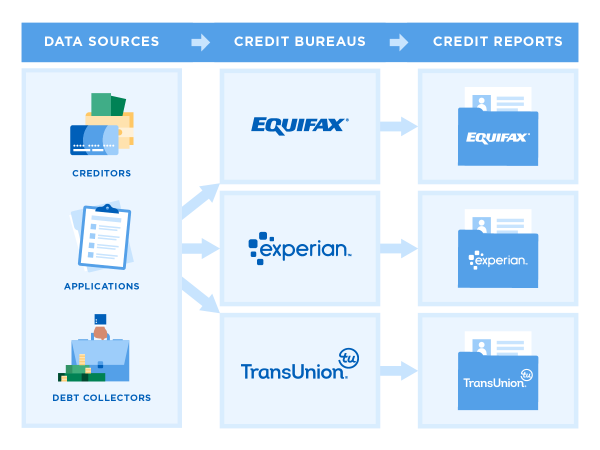

How to Get a Credit Report

There are three main credit reporting agencies where you can obtain your credit report, Equifax, Experian, and TransUnion. Each of these institutions gathers the information on you from a host of sources and they put it all together into a readable document. You can obtain a free credit report from these agencies once a year through www.annualcreditreport.com.

Information on the 3 Credit Bureaus

The three main credit bureaus used in the United States are Experian, TransUnion and Equifax. These agencies collect and collate personal information, financial data and non-financial data (such as utility, rental, and telecommunications payments) on individuals from a variety of sources called data furnishers with which the bureaus have a relationship. Data furnishers are typically creditors, lenders, utilities, debt collection agencies and the courts.

What is FCRA – The Fair Credit Reporting Act

The Fair Credit Reporting Act (FCRA) is a U.S. federal law that regulates the collection, dissemination, and use of consumer information, including consumer credit information.

Do It Yourself Credit Repair

The first step in cleaning up your credit is to dispute the negative information on your credit reports. You will need to send a letter to each of the three credit bureaus. Each letter should have the negative entries listed out as germane to that particular report. For example, TransUnion might not have the exact same negative entries as Equifax. So, you must review each report thoroughly and address the negative entries only listed on that particular report.